Quality Carves Up the Afforestation/Reforestation Market

Buyers’ evasion of reputation risk in recent years has divided the market for afforestation, reforestation and revegetation carbon credits into the haves and have nots, all but eliminating the supply of credits from certain projects.

“Basically, there’s scarcity of credits that clear a quality bar,” said Micah Macfarlane, chief supply officer at Carbon Direct. “We would say the same in terms of all nature-based removals. And that’s true in 2025 but also out through 2030.”

Carbon Direct, which advises clients on carbon credit acquisitions and manages their portfolios, expected demand for nature-based removals to hit 40 million credits per year by 2030. Its analysis estimated that future supply of high-quality credits would satisfy roughly half of that.

Carbon Direct, which advises clients on carbon credit acquisitions and manages their portfolios, expected demand for nature-based removals to hit 40 million credits per year by 2030. Its analysis estimated that future supply of high-quality credits would satisfy roughly half of that.

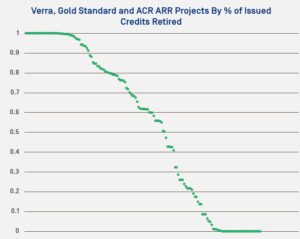

Of the 123 ARR projects registered with Verra, 64 have had 80% or more of their issued credits retired and 32 had 100% of their credits retired, registry records showed.

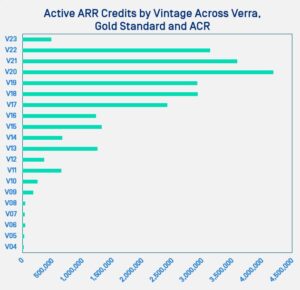

Between Verra, Gold Standard and ACR, registered ARR projects had 25.6 million active credits. An unknown portion of those have been sold and held for future trading or retirement.

Among active ARR credits, 9.6 million were V20 to V23, while 14.4 million were V19 or older. The remainder were Gold Standard planned emissions reductions.

Beyond credit vintage, a more cogent distinguisher of quality has become the type of ARR activity. Projects that replant non-native and monoculture tree species have come to be viewed as lower quality, while those that focus on rewilding degraded landscapes see the strongest demand.

The same is true for projects that replant trees on land that was previously used for commercial purposes, which would denote lower quality. Projects that restore previously deforested areas or plant trees on degraded land that haven’t been forested for decades are viewed in a better light.

The same is true for projects that replant trees on land that was previously used for commercial purposes, which would denote lower quality. Projects that restore previously deforested areas or plant trees on degraded land that haven’t been forested for decades are viewed in a better light.

Forest First Colombia straddles those quality dividers. It launched its ARR project, Afforestation of Degraded Grasslands in Vichada, Colombia, under Verra’s VCS and CCB methodologies in 2016, before today’s quality signifiers were widely agreed in the voluntary carbon market.

The project planted eucalyptus and acacia trees in degraded grasslands near where farmers regularly burn their fields to support the next years’ growth for grazing their cattle. It was established as a joint timber plantation and ARR project, where a portion of the area would be harvested and replanted. The rest would be left to grow to sequester carbon and foster biodiversity.

“Despite our contributions to the climate, environment and biodiversity, the number of investors who have turned us away because we’re ‘monoculture’ is extraordinary,” Forest First Colombia Founder and Chief Financial Officer Jonathan Dodd said. “We’re the only forestry company we know of in the world that conforms to the International Finance Corporations’ ESG Performance Standards.”

Forest First Colombia has enhanced its ARR practices and begun to dedicate half its land to native regeneration. It was considering re-verifying under Verra’s updated VM0047 methodology, Dodd said.

The company has sold a portion of the credits it received in its latest verification round in February. The prices they attained were lower than what the project had managed in the past, Dodd said.

Forward-Looking Buyers Have Gone from Spot Trades to Future Offtake

Price indications for ARR credits have been heard by OPIS in the spot market this year from anywhere between $1/metric ton to $33/mt. The majority have involved monoculture projects and ranged between $15/mt and $20/mt. The OPIS ARR V21 30-Day Average finished September at $17.227/mt.

In the absence of available mixed-species ARR supply, many buyers have begun to forward contract credits from new and existing projects over three- to 15-year periods. Forward price curves for mixed-species ARR tend to sit between $50/mt to $70/mt and increase over time, several sources told OPIS.

“I think it’s hugely productive and necessary,” Macfarlane said. “By virtue of being contracted and bankable, new projects can get the finance they need. If you’re measuring the market by number of individual buyers, more are on an annual cycle than on a multi-year cycle. So, we’re in that transition now. If you’re measuring the market by volume, though, the big buyers are the ones that are moving into large, forward offtake procurement.”

Multiple sources expected that, over time, the price of nature-based removal credits will begin to converge with durable carbon dioxide removal credits. Puro[dot]earth, a CDR registry, saw average biochar prices fall from €140.49/mt ($165.25/mt) at the start of the year to $144.27/mt in July, according to its Biochar Price Index.

Blended Funding Becomes Viable

Many developers have expressed the view that restoring or protecting ecosystems via philanthropy or government funding can be inconsistent and only get projects so far. But that calculus has begun to shift.

Terraformation, which is developing nature restoration projects around the world, has sought to blend financing between philanthropy, emissions mitigation under Article 6 of the Paris Agreement and voluntary purchases, Head of Carbon Strategy Xavier Hatchondo said.

“The investment model has really changed a lot in the last five years,” Hatchondo said. “I won’t say it’s easier now to get funding. But it has changed.”

The developer won a government tender this month to supply credits to a country in Southeast Asia with credits eligible under Article 6.2 of the Paris Agreement. According to Hatchondo, the process took six months and was simpler than answering a request for proposals from the

private sector.

“It’s really game-changing,” Hatchondo said. “[These tenders] can totally de-risk projects before they issue any credits.”

The developer still engages in the voluntary market. It sold future credits from its Regenerative Development of Anlo Wetlands, a mangrove restoration project, to Grosvenor’s UK property division in 2024, Terraformation announced at the time.

Those credits were priced at “just below” $50/mt, according to a June 2024 news release. Hatchondo said Terraformation takes a conservative approach to its forward price curves, but they have still climbed to between $50/mt and $60/mt since last year.

The broader VCM has “learned a lot,” Hatchondo said. “We continue to improve. We try to improve our standards; we try to improve the methodologies. We are all working together to improve. I think [credit prices] will improve in the future too.”