Who uses this report?

The OPIS Mexico Fuels Report is a vital resource for a wide range of market participants, including:

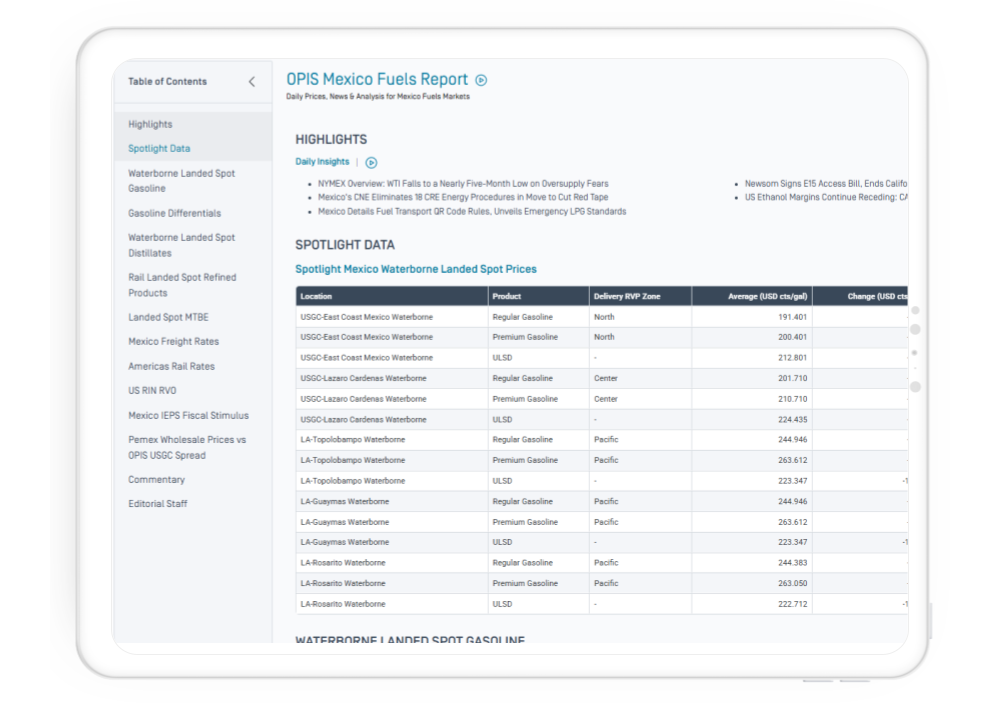

- Fuel importers and marketers, who need accurate build-up cost estimates to assess arbitrage, secure contracts, or optimize sourcing strategies.

- Retail fuel networks, who use landed spot-to-retail modeling to protect margins and benchmark competitiveness against PEMEX or private rack prices.

- Trading firms and refiners, who rely on these numbers to price export cargoes, forecast flows, and react quickly to market disruptions.

- Financial institutions and consultants, who apply the data to feasibility studies, investment evaluations, and risk modeling.

For example, a private importer supplying stations in northern Mexico can compare landed spot prices from the U.S. Gulf Coast versus Pacific Coast alternatives, layered with transport and additive costs, to decide which route offers the best economics. Retailers can also analyze the spread between landed spot prices and local retail or rack rates to manage pricing strategies more effectively.

With Mexico’s recent fuel market shifts — from capped retail regular gasoline prices to tighter margins — gaining full visibility across the value chain is essential to making smarter decisions and strengthening negotiations with your counterparties.

Learn more about OPIS Mexico Fuels Report:

- View the Mexico Fuels Report fact sheet in English. Ver hoja informativa en español.

- Read the OPIS Mexico Fuel Pricing Products Brochure to learn more.